News

By Jessica Castellino, Deloitte

•

January 24, 2024

The previous blogs in this series gave an overview of hybrid advice, trends in the market and methods firms can use to develop a hybrid advice process. As a reminder, hybrid advice combines components of traditional human-based financial advice and self-service digital advice, offering a flexible and tailored wealth management solution to clients. Firms operating hybrid advice models are faced with ever increasing regulatory pressure, with further change on the horizon such as the Advice Guidance Boundary Review and Core Investment Advice Regime. It is imperative for firms to be thinking about how they optimise these regimes to meet the evolving regulatory requirements. This blog explores the regulatory challenges firms may encounter when developing a hybrid advice process. We outline four key considerations firms must make and discuss the opportunities and risks associated with each: Existing Regulatory Challenges 1. Conducting investment suitability to the level of detail required to create detailed advice reports – ensuring digital/tech solutions do not hamper suitability capabilities. Suitable investment advice is central to the advice market proposition, and for years, advisers have honed and fine-tuned their first and second line suitability processes. Whilst its ever important to move with the times, and leverage technology solutions available to the advice market, it’s even more important to ensure those solutions don’t hamper the quality suitability processes already built into firm operating models. Quality suitability is historically dependent on the ability of an adviser to understand and assess many facets of the client's needs, objectives, capacity for loss and attitude to risk. When firms are looking to automate and digitalise elements of this process, they need to ensure the assessment activities and data collation remain the central focus. 2. Collating KYC – ensuring the information is relevant, useful and most importantly correct. Many firms use online account opening forms. One of the simplest ways to ensure firms are capturing the correct information they need is to mandate sections forms to be filled out and build in checks to ensure applications cannot progress without all information required contained in the submission. Mandating form filling does not however mitigate all the risks. Clients could still very well submit irrelevant or inaccurate information. Given the need to ensure the suitability of advice is personal, depending on what service firms are offering, there should always remain an element of human oversight within the account opening and KYC/information gathering process. Even where risk profiles are automatically calculated, and managed portfolio solutions are recommended, the human error risk should always be mitigated by proportionate first line controls. Firms could also consider enhanced account opening testing based on risk profile/capacity for loss in the recommended investment solution, or higher risk investor characteristics of vulnerability. 3. COBS 101 Appropriateness – gaining comfort that firms digitalised appropriateness testing really does identify client K&E Firms are required to assess the knowledge and experience of investors purchasing complex products under COBS 10 (the appropriateness test). Where firms create a digital distance between adviser and client, it becomes even more important to focus on the assessment capabilities of any digital solutions used. Firms relying on the adviser’s knowledge of their client can carry out assessments of the client knowledge and experience via traditional paper assessment forms and exercise human judgement based on the client responses given. Firms using online automated response assessments should consider the quality and robustness of that assessment however. Good practise is to integrate an element of ‘testing’ into the digitalised assessment, to ensure that the firm can evidence that the client does indeed have the knowledge. Some firms have also provided the client with the knowledge of the complex instrument, before requiring them to complete an online test to ‘assess’ their knowledge of the risks associated with investing in complex products. Firms wishing to automate elements of their COBS 10 activity should ensure their processes make use and comply with all requirements of the regulation, including the capability of firms to give the required knowledge to the client, and test their understanding of that knowledge, as well as assessing their experience. 4. Target Market tracking – Consumer Duty Outcome 1 adherence2 Under the Consumer Duty, advisers should ensure their products and services are distributed into the target market and develop a distribution strategy which facilitates this. When utilising hybrid advice models, it’s important to build in controls to monitor sales in the target market, as well as how any hybrid elements (e.g. automated risk profiling tools; digitalised investment selection offerings et al.) maintain adherence with the distribution strategy. Firms may wish to enhance their 1/2LOD controls in this area to ensure that new activity under Outcome 1 of the Duty in operating effectively. New And Emergent Regulatory Change There is potential regulatory change on the horizon for firms offering hybrid advice models. The Core Investment Advice Regime3 is a narrower scope regime than holistic advice reducing the required qualification levels for advisers providing core investment advice, and simplified the suitability process, potentially allowing firms to offer a lower cost advice solution for a slimline range of investments. With the Advice Guidance boundary review4 still underway too, firms currently offering or wishing to offer hybrid advice models will potentially have a new range of regulatory tools at their disposal to streamline and consolidate hybrid propositions. Like holistic advice models however, demonstrating fair value under the consumer duty price and value outcome still remains. Firms are expected to assess the provision of services offered to clients and whether they offer fair value, meaning that the price paid is commensurate with the benefits received from the service. When considering this through the lens of hybrid advice, firms need to take care that they don’t overestimate the value provided by digitalised or automated elements of the service, and that they develop a proportionate analysis methodology to ensure the assessment of the service in its totality is robust. Conclusion The existing regulatory landscape presents enough challenges for firms with hybrid advice models to grapple with however there are still more challenges on the horizon. The Consumer Duty fair value requirements are forcing firms to revisit the client benefits in existing hybrid advice models, and question existing perceptions of value within advised services. The Advice Guidance Boundary Review and the Core Investment Advice Regime do however offer a glimmer of hope for firms looking to streamline their hybrid advice models going forward. Look out for future blogs in this area, as we explore the potential impacts of the Core Investment Advice Regime and Advice Guidance Boundary Review, as well as a deep dive into the application of the Consumer Duty Price and Value requirements within hybrid advice models. To discuss more about the future of regulation might affect hybrid advice models, please get in touch.

By This is Money

•

January 23, 2024

In this series, we bust the jargon and explain a popular investing term or theme. Here it's Hybrid Advice. Is this gardening related? Nothing to do with new plant varieties, but a form of financial advice also known as 'tech-enabled'. It is a mix of digital and old-fashioned advice from a person. The excitement about hybrid advice has replaced the enthusiasm for 'robo-advice' in which all processes are automated. Both are cheaper than hiring a wise and knowledgeable human being to help with your financial affairs. What's involved? Hybrid advice combines 'human-assisted' personal guidance on investment and other financial decisions, provided in person, on the phone or online, with a 'consumer-led' DIY automated service on a platform, which is an online financial supermarket). So, a qualified individual might give you recommendations on strategy which you implement yourself online, or via an app. How big is the market? Huge, according to proponents. The ageing of the population suggests that demand will grow as more people seek help on making the most of their retirement savings. But, although some believe that the hybrid model is the future of the £2trillion financial advice sector, others are dubious. They think that, a bit like hybrid working where people toil partly in the office and partly at home, it could result in serious problems. Why is it a talking point now? Hargreaves Lansdown (HL), the name behind the UK's largest investment platform, has plans for a hybrid advice division which aims to provide quarter of the company's new business by the middle of this decade. About 10,000 of HL's existing customers receive personalised advice at present. But it seems that others often go elsewhere for such guidance when they become wealthier. the typical annual charge for personalised advice is 1.5-2 per cent. At HL, the hybrid advice fee would be lower. Is everyone convinced? Er...no. Peter Hargreaves, HL's billionaire founder and its largest shareholder, with a 20 per cent stake, is bitterly opposed to the scheme. This week he described it as 'irrelevant', claiming that it is the reason for the 38 per cent fall in HL's share price over the past 12 months. This decline has also been a source of woe to those who hold HL through a fund or trust. The LF Lindsell train UK Equity and global Equity funds and the Liontrust Special Situations fund own shares in the company. Why is Hargreaves so worked up? He contends that HL is being distracted from its core business. He also argues that there is a risk that those who use the hybrid service could be directed towards wrong types of investment. Who's providing hybrid advice? Names like Abrdn, Bestinvest and vanguard. Others are talking about launching a service. Holly Mackay, chief executive of the Boring Money website, says those interested should compare the various offers. Some are designed for investors who are starting out, others for those who have already built a portfolio, while a number cater for a broader range. Boring Money has a comparison table.

By Lois Vallely

•

January 23, 2024

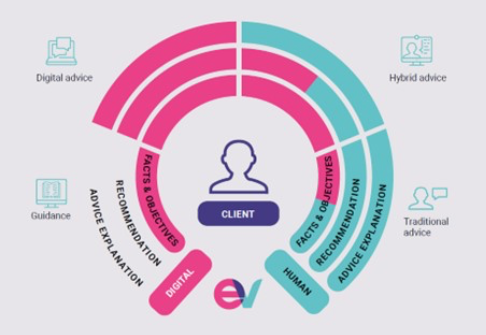

Hybrid advice will be essential in plugging the gap between financial guidance and so-called “full fat” advice, financial planning software firm EV has insisted. In a re port published today (25 April), it said there are “clear opportunities” for advice firms to use digital and hybrid advice as a part of their customer propositions.“Digital and hybrid advice makes it both simpler and more cost-effective to serve more clients successfully,” it added. “If we look at where we are in the market today, in terms of individuals getting support and help, the two fundamental ways people do access support is either guidance or the traditional advice route,” EV managing director Chet Velani told Money Marketing . “Guidance is more of a mass-market proposition. It can work well for less complex areas like simple investment and pre-retirement. “But I think, for most people, when it gets to more complicated areas like at retirement or in retirement, guidance just doesn’t go far enough. “Guidance offers a mass market solution, but with no personal recommendation,” Velani added. On the other end of the scale, he said, traditional advice is mostly a manual process. But that means it is quite expensive. “If we look at retirement, for example, an individual is likely to pay somewhere between £2,000 and £3,000 for advice,” he added. “That just isn’t affordable for most individuals.” The report pointed out that hybrid and digital advice are not a ‘one size fits all’ proposition. “Every firm will have its views on, among other things: the mix of human support and digital advice; the order and priority of advice areas to be addressed; and how to integrate a hybrid and digital proposition with traditionally delivered advice,” it said. “This last point is important because traditional advice may be identified as more appropriate for some customers in going through a hybrid and digital process.” It said this might occur, for example, where more than one financial need area needs to be addressed simultaneously. The report outlined numerous areas where hybrid and digital advice can be deployed, including investment, pre-retirement, at-retirement, in-retirement, product consolidation (mostly pension switching), mortgage protection, family protection and inheritance planning. Digital algorithm-driven advice could serve the mass-market with simple needs, with hybrid and digital advice supporting those with more complex requirements. Traditional advice can, of course, remain in place for the wealthier segment who value the full attention of advisers and can happily pay for it. “Some customers going through a hybrid and digital process may decide that traditional advice better meets their ongoing needs,” the report added. “Similarly, customers with access only to guidance may decide that low-cost hybrid and digital advice gives them the comfort they need.” Velani said: “What we’re trying to do with digital and hybrid advice is to support those individuals who are in the advice gap, where guidance doesn’t go far enough, but can’t go for traditional advice.”

By Wealth Wizard webinar

•

January 23, 2024

The vast majority of advisers (91%) participating in this week’s LIBF webinar – Hybrid Advice, will it become the future of advice -said it was very likely (52%) or some what likely (39%) their company would implement a hybrid advice model in the next three to five years. Just 9% said it was unlikely or not likely. The in-webinar poll of nearly 260 attendees was one of three during the webinar, with other polls showing that 45% of advisers were with firms already heading down the hybrid route and 42% believed that hybrid advice would result in more advisers developing their knowledge and skills to a Level 6 qualification, as more advisers focussed on complex advice that required a human element, allowing technology to help progress clients’ more straightforward advice requirements. Webinar panel participant Nick Hall, Head of Advice, Wealth Wizards, comments: “The poll results are very encouraging and reflect the level of traction that hybrid advice is gaining in the financial advice market. Hybrid advice blends the human touch with digitisation and automation, to create an advice experience the customer would want and expect from their advice firm, particularly following the pandemic where familiarity with digital has increased significantly.” “It’s clear that both advisers and their clients are already on an advancing technological journey and the pandemic has pressed the accelerator on that change.” Hall says there are four benefits for clients in delivering advice through a hybrid model. 1. Better engagement with the client - using techniques such as chat bots to help clients through the fact find and onboarding process and providing two-way communication with an adviser and with the advice firm’s brand 24/7. 2. Choice - UK consumers now want more choice as to the kind of assistance they want – basic help, guidance or full advice – and how they receive it. For example, if a customer wants to top-up their ISA and just wants some self-serve guidance, hybrid advice means they can get it as part of the adviser brand. It is a way to help narrow the Advice Gap. 3. Multi-channel approach - Hybrid advice should be about interaction whether through technology or a human adviser. If a customer wants to interact digitally in the evening or see an adviser face-to-face, there are different channels available through their financial advice firm. 4. Consistency. Algorithm logic provides a consistent approach throughout the advice process, aligning to the advice firm’s advice policy. Hall says: “Where hybrid advice can deliver for financial advice firms is in taking on the heavy lifting of the advice process, allowing financial advisers to focus on the client relationship and the elements of advice that need human contact.” “This makes use of customers self-serving and the automation of advice processes, letting the financial adviser talk to the customer when they want to and when needed.” Hall continues: “The financial adviser is at the heart of the advice process; technology should be used to make advisers’ lives easier. It’s looking at the end-to-end process and seeing where technology can take on some of the heavy lifting – we’ve seen end-to-end processes in advice firms 35-50 hours to complete. Technology can cut that right down to sub-10 hrs.” Heavy lifting can be separated into four elements, Hall says: 1. T he onboarding process - “This should be a digital process, not a long-winded one for the customer to start engaging with you.” 2. The fact finding - “Customers can digitally complete the hard-facts, and do the hybrid/human part for the soft-facts, which are the dreams and aspirations of the customer.” 3. The diagnosis - “Every advice firm has an advice policy, a way they deal with various aspects of advice. Algorithms can be designed that match to the advice policy, meaning there is no longer a need to spend 4-7hours in diagnosis. An algorithm can align to the advice policy and the cashflow modelling, so ultimately that part is removed from the adviser’s task list. The adviser still has control over the process but consistency of approach is provided across the advice process and across the business.” 4. Suitability report writing. “Firms are spending up to 6-7 hours writing suitability reports. We have driven that down to 30-35 minutes, through using personal objectives that are keyed into the fact find. As you are talking to your customer the suitability report is being written behind the scenes. That’s how far technology has progressed.” The end result of letting technology take the heavy lifting, in a real-world customer case study, has been proven to drive down the end-to-end advice process from 35 to nine hours, Hall adds. “Hybrid advice provides for a better experience all round. For the customer, who feels the same pain-points in a process as the adviser, and for the adviser, who has more quality time building the relationship with the customer, focusing on client objectives and dealing with the more complex advice issues, as well as having their time freed up to see more customers.”

By James Richards, Intelliflo FTAdviser

•

January 23, 2024

In the context of holistic financial advice, it is crucial to acknowledge the significance of the human connection advisers have with their clients. Although technology is unlikely to replace advisers anytime soon, it can be a valuable tool for building a better and stronger relationship with your clients. This article explains why we believe this is the case. Evolving client base We know the traditional advised client will likely be older and already fairly wealthy. The Lang Cat’s Advice Gap 2023 research found that more than half of advised clients are aged 55 and above and the most frequent portfolio size was £250,000 (the mean average was £350,000). Although there will always be wealthy clients who need financial advice, the shape of wealth across the population is changing. A recent report into the UK pensions system by the Institute for Fiscal Studies suggests that most people are not saving enough into a pension. Three-fifths of middle-earning private sector employees are saving less than 8 per cent of their earnings, while 87 per cent are saving less than 15 per cent, which is the level the Pension Commission thought appropriate. At the same time, home ownership is declining, with the latest census data showing a large drop in the number of homes owned with a mortgage and a large rise in privately rented dwellings in the past decade. Part of the problem is that households have been facing a squeeze on their money in recent years. According to the Resolution Foundation, typical incomes are expected to remain below their real-terms pre-pandemic level for at least five years. Embracing technology Faced with the very real prospects of clients coming down the track with less pension and housing wealth, how can you make the cost of servicing lower-value clients viable for your business, without losing the human relationships that are crucial to delivering trusted advice? The answer can very much be in using technology. It can drive efficiencies, streamline processes and deliver some of the journey, leaving advisers more time to spend on the more valuable aspects of advice. We see the future of advice as hybrid, with the adviser at the centre and technology providing robust support. By fully embracing technology, you can deliver advice efficiently and profitably. Let’s consider when a client first comes to you for advice. You can give them access to your client portal and ask them to complete some of the information for the initial fact find. They can upload their ID documents, so they do not need to remember to bring their passport or driving licence for your first meeting. Automatic prompts can encourage the client to start completing their personal details, family information, employment details and upload existing product information. They can record as much or as little information as they want, but asking the client to do this at a time convenient to them, when they are more likely to have all the details to hand, can save significant time in the face-to-face meeting. It also means the information should be completed correctly from the start. If the client is comfortable doing so, they can also link their bank account and credit cards to the portal via open banking. This integration can help populate some of the income and expenditure information, so neither of you will need to complete this manually. As the data is drawn directly from their banking information, it can also create a more accurate picture of the client’s wealth and outgoings, rather than the guesstimates you might have to come up with during a face-to-face meeting. With the client data already available you can hit the ground running at the first meeting. The portal may also include some simple forecasting tools, using their own data and basic scenarios to help the client think about how much money they might need to achieve their goals and inform their expectations. This can also give you a lot of insight into their financial aspirations, even before the first meeting. Asking the client to complete a lot of the groundwork in advance frees up time in the face-to-face meeting to have a more meaningful conversation and better understand the client and their needs. With the client data already available you can hit the ground running at the first meeting. You can also use the time more effectively, to understand your client’s objectives and deliver a better outcome instead of having your head buried in a laptop writing down their date of birth and national insurance number. By fully embracing technology, you can deliver advice efficiently and profitably. And you will also have time to build strong ongoing relationships that instil confidence and trust in your expertise and recommendations. James Richards is customer solutions manager at Intelliflo

Hybrid Advice Group is comprised by Hybrid Advice Limited, registered in Jersey (registration number 151793) and Hybrid Central Limited, registered in England and Wales (registration number 08168055)

Hybrid Advice Central Limited, is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 711110)

Hybrid Advice is a trading name of Hybrid Advice Central Limited, other trading names include: Southernhay Financial Planning and D'Arblay Wealth